What Is The Useful Life Of A Computer For Depreciation Purposes . Use the modified accelerated cost recovery. if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. if you used the computer for more than 50% business use, you can either: for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are.

from www.slideserve.com

if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. Use the modified accelerated cost recovery. if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. if you used the computer for more than 50% business use, you can either: by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are.

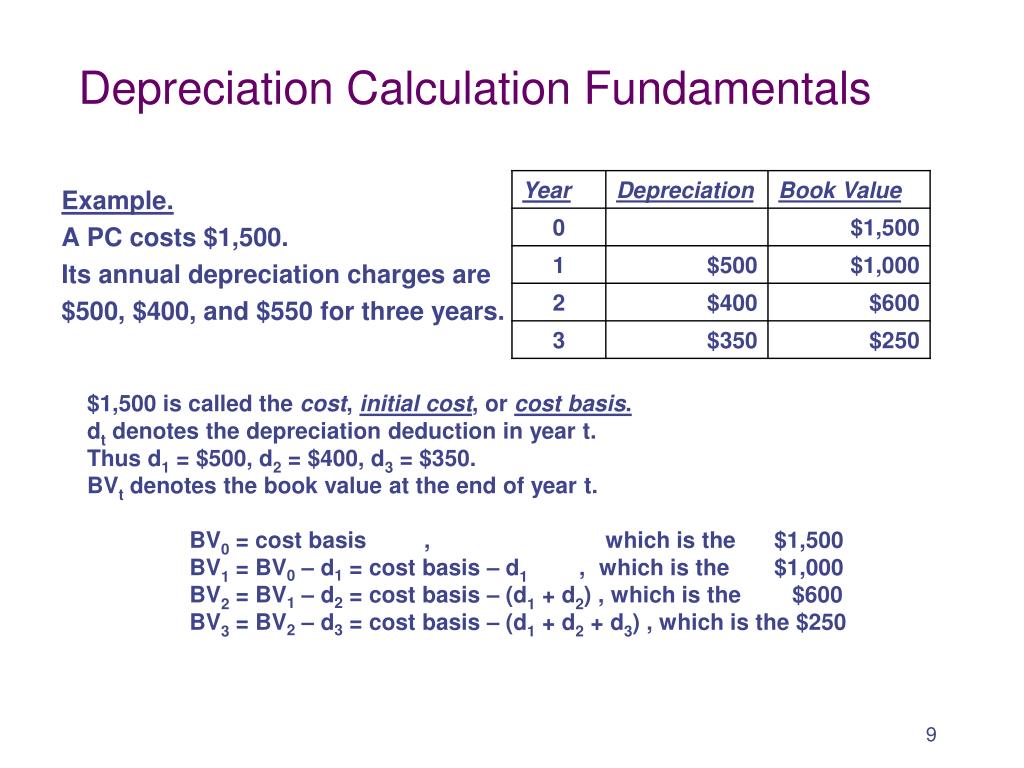

PPT Chapter 11 Depreciation PowerPoint Presentation, free download

What Is The Useful Life Of A Computer For Depreciation Purposes by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. Use the modified accelerated cost recovery. for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. if you used the computer for more than 50% business use, you can either:

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy What Is The Useful Life Of A Computer For Depreciation Purposes for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.chegg.com

Solved Apex Fitness Club uses straightline depreciation for What Is The Useful Life Of A Computer For Depreciation Purposes if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. if you used the computer for more than 50% business use, you can either: if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. for. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.wallstreetprep.com

What is Depreciation? Expense Formula + Calculator What Is The Useful Life Of A Computer For Depreciation Purposes by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if you used the computer for more than 50% business use, you can either: if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. for example, you are. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.slideserve.com

PPT DEPRECIATION ACCOUNTING PowerPoint Presentation, free download What Is The Useful Life Of A Computer For Depreciation Purposes if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year. What Is The Useful Life Of A Computer For Depreciation Purposes.

From businessyield.com

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should What Is The Useful Life Of A Computer For Depreciation Purposes by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.wallstreetprep.com

Useful Life Formula + Calculator What Is The Useful Life Of A Computer For Depreciation Purposes if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. Use the modified accelerated cost recovery. if a computer costs $1,200 and has a useful life of three years,. What Is The Useful Life Of A Computer For Depreciation Purposes.

From cyberblogindia.in

Depreciation Rate for Computer and Related Devices The Cyber Blog India What Is The Useful Life Of A Computer For Depreciation Purposes if you used the computer for more than 50% business use, you can either: if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. Use the. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.irstaxapp.com

Depreciation MACRS Table for Asset's Life Internal Revenue Code What Is The Useful Life Of A Computer For Depreciation Purposes for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. if you used the computer for more than 50% business use, you can either: Web. What Is The Useful Life Of A Computer For Depreciation Purposes.

From elchoroukhost.net

Macrs Ads Depreciation Table Elcho Table What Is The Useful Life Of A Computer For Depreciation Purposes for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.homeworklib.com

Estimating Useful Life and Percent Used Up The property and equipment What Is The Useful Life Of A Computer For Depreciation Purposes if you used the computer for more than 50% business use, you can either: Use the modified accelerated cost recovery. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.studocu.com

Chap 10 (p1) A it is helpful What is the amount of depreciation What Is The Useful Life Of A Computer For Depreciation Purposes if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. if a computer costs $1,200 and has a useful life of three years, the. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.calt.iastate.edu

Depreciating Farm Property with a FiveYear Recovery Period Center What Is The Useful Life Of A Computer For Depreciation Purposes if you used the computer for more than 50% business use, you can either: if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. Use the modified accelerated cost. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.chegg.com

Solved The depreciation schedule for certain equipment has What Is The Useful Life Of A Computer For Depreciation Purposes for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. if you used the computer for more than 50% business use, you can either: if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. Use. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.fastcapital360.com

How to Calculate MACRS Depreciation, When & Why What Is The Useful Life Of A Computer For Depreciation Purposes if you used the computer for more than 50% business use, you can either: for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. Use the modified accelerated cost recovery. if a computer costs $1,200 and has a useful life of three years, the annual. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.studocu.com

Chapter 27 Depreciation Problem 275 (AICPA Adapted) Silent Company What Is The Useful Life Of A Computer For Depreciation Purposes for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. if you want a quick and easy way to determine useful life, the irs provides standard useful lives for specific classes. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies. What Is The Useful Life Of A Computer For Depreciation Purposes.

From ashleyvaniza.blogspot.com

Computer depreciation life AshleyVaniza What Is The Useful Life Of A Computer For Depreciation Purposes by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. if you used the computer for more than 50% business use, you can either: Use the modified accelerated cost recovery.. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.chegg.com

Solved Penguin Network Warehouses, LLC MACRS Depreciation What Is The Useful Life Of A Computer For Depreciation Purposes for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. if a computer costs $1,200 and has a useful life of three years, the annual depreciation expense would be $400. if you used the computer for more than 50% business use, you can either: Use. What Is The Useful Life Of A Computer For Depreciation Purposes.

From www.chegg.com

Solved Comparing three depreciation methods Dexter What Is The Useful Life Of A Computer For Depreciation Purposes for example, you are probably eligible to elect section 179 to fully expense the cost of computers in the year they are. by adopting a meticulous approach and utilizing a fixed asset useful life table, companies can enhance the. if you used the computer for more than 50% business use, you can either: Use the modified accelerated. What Is The Useful Life Of A Computer For Depreciation Purposes.